Overdraft means unfavaurable balance or Negative Balance

Hence put it under – item.

Explanation for all other items is similar as example 1 except the following.

Hence this is a (–) item or in other words overdraft as per Pass Book.

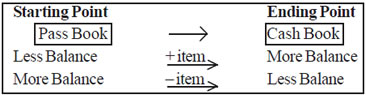

Case II – Starting with Pass Book Balance / overdraft.

1. First of all write under

+ Item – If Cr Balance, favaurable balance or Simply Balance as per Pass Book is given. [ 60 ]

(–) Item - If Debit Balance or overdraft as per Pass Book is given.

2. Now study the point of difference between the Cash Book and Pass Book.

(a) If the entry is done in the Cash Book and not in the Pass Book then.

- If is done on the Debit side of Cash Book Balance in the Cash will be more as compared to Pass Book and hence the item is to be added in the Pass Book Balance to get the Cash Book Balance i.e. + item.

- Where as if the entry is done on the Credit side of Cash Book Cash Book Balance will be less as compared to Pass Book hence (–) item

(b) If the entry is done in the Pass Book and not in the Cash Book then.

- if it is done on the Debit side of Pass Book Pass Book Balance is less as compared to Cash Book item is to be added in Pass Book Balance to get the Cash Book Balance + item.

- if is done on the Credit side of Pass Book Pass Book Balance is more as compare to Cash Book item. (-) item

3. At the end + item and – item are totalled

Ready Reference

+ Items [items which increases the Cash Book Balances or decreases the Pass Book Balance]

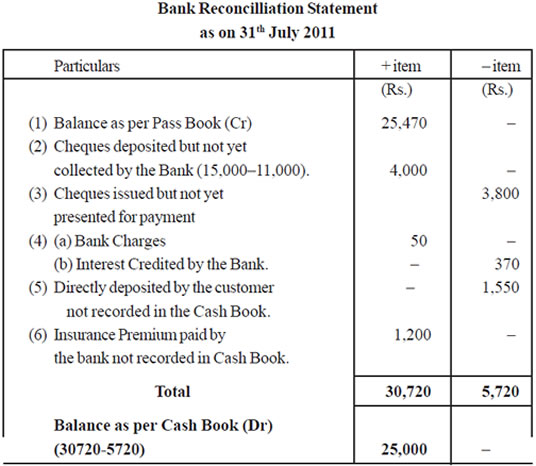

EXAMPLE 3 - Balance as per Pass Book is given

Given (1) Balance as per Pass Book is Rs. 25,470 Point No. (2) to (6) are same as given in example (1) Prepare B.R. Statement for the month of July 2011. [ 61 ]

SOLUTION :

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : maheshwari1569@gmail.com