Note : (1) Closing stock is recorded cost or market price whichever is lower.

(2) Outstanding Wages and Salary Rs. 5,000 added to Wages and Salary in debit side of Trading A/c and Shown in liabilities side of B/S.

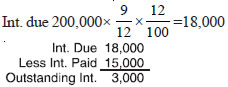

(3) Interest Loan is calculated for 9 Months.

01/07/2010 to 31/03/2011 — 9 Months.

Ontstanding Interest 3000 Shown in profit and loss Dr. side and Liabilites side of Balance sheet.

(4) Inerest on Investment is due for 12 month

Less Interest Recivied 9,500

Interest accrued but not received Rs 2,500

Rs. 2,500 will be added to interest recieved amount in profit and loss Credit side

and in Assets side it will shown in balance sheet.

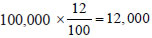

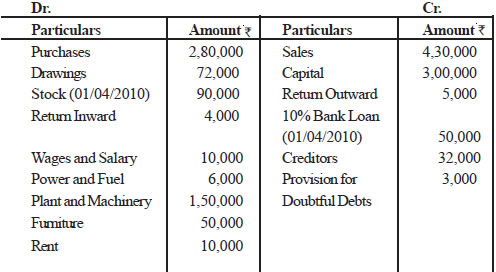

Illustration No. 10.

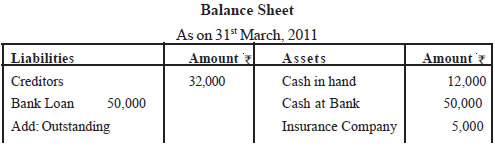

From the following Trial Balance of M/s Rahul Traders as on 31st March 2011.

Prepare Trading and Profit and Loss Account and Balance Sheet on that date.

Aditional Information :

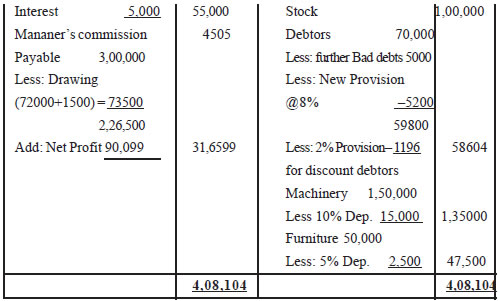

(1) Cost of stock as on 31.03.2011 stand at Rs.1,20,000, while market value of the same was Rs. 1,00,000.

(2) Provide depreciation on Plant and Machinery and furniture @ 10% and @5% respectively.

(3) Sundry debtors Includes an amount, Rs 500 due from Sohan, who has become Insolvent.

(4) A provision for doubtful is to be creats @5% on Sundry debtor and a provision for discount on debtor @2% to be made on debtors.

(5) Goods costing Rs. 8,000 have been destroyed by fire and insurance company admitted a claim for Rs. 5,000 only.

(6) Goods costing Rs. 2,000 were distributed as free samples while goods costing Rs. 1500 were taken by the proprietor for personal use.

(7) Provide for manager’s commission at 5% on Net profit after charging such commission.

Note:.

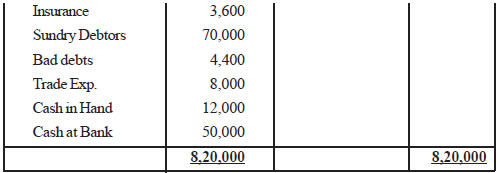

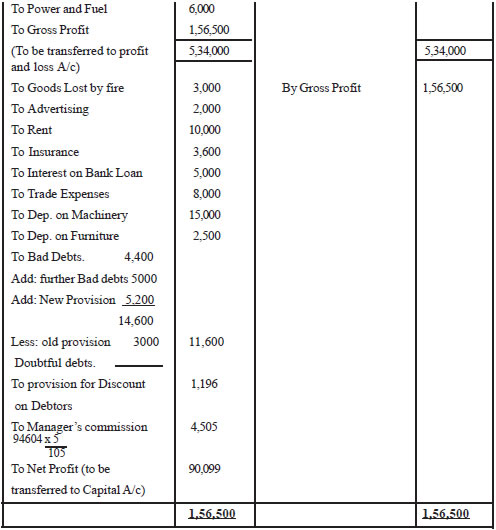

(1) Net profit before charging manager's commission is Rs . 94,604 (1,56,500 – 61,896)

(2) The amount of purchases is redirect by the amount of good distributed as free sample and the drawing of goods.

(3) Goods lost by fire credited to Trading A/c by cost 8,000 Rs 3,000 is net loss because it is not recoverable from insurance co. So Rs 3,000 debited to P & L A/c and Rs. 5,000 claim accepted by musurance Co. is Treated as assets in balance sheet.

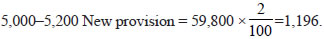

(4) Provision for discount on Debtors is always calculate on the good debtors i.e., after deducting bad debts and New provision i.e., 70,000–

(5) New provision for doubtful debt is calculating on debtors which are not bad i.e. the amount of bad debt is reduced from sundry debtor& then we calculate new provision i.e. 70,000 – 5,000 Bad debts =

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]