Cash-III : When opening capital is given

Illustration 3

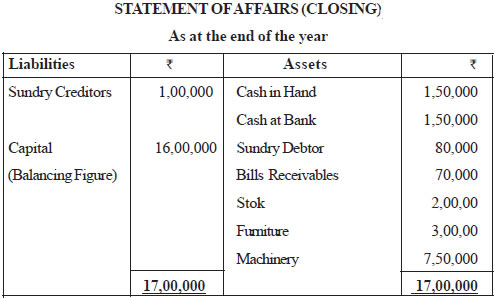

Ms. Preeti started a business with a capital of Rs. 10,00,000. At the and of the year her

position was :

| Particulars | Amount Rs. |

| Cash in Hand | 1,50,000 |

| Cash at Bank | 1,50,000 |

| Sundry Debtors | 80,000 |

| Bills Receivables | 70,000 |

| Stock | 2,00,000 |

| Furniture | 3,00,000 |

| Machinery | 7,50,000 |

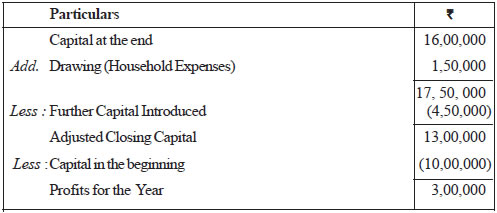

Sundry creditors on this date was Rs. 1,00,000 . During the year she introduced a further capital of Rs. 4,50,000 and withdraw for household expenses Rs. 1,50,000. You are required to ascertain the profit or loss during the year

Solution :

Statement of Profit or loss

For the year ended on ................

Note :

'Statement of Affairs' at the beginning of the period is not prepared because

Opening capital is given in the question.

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]