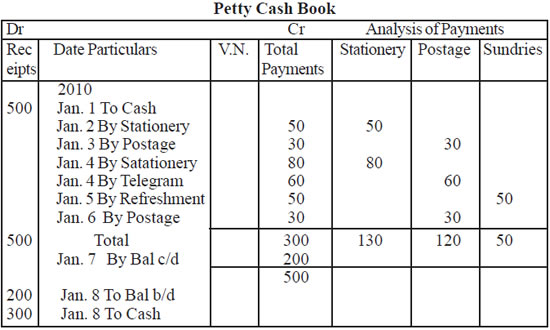

Illustrations 5: Prepare a Petty Cash book on the imprest system from The following transactions

2010 |

|

|

|

|

Amt (Rs.) |

Jan. 1 |

Received from Head cashier |

500 |

|||

Jan. 2 |

Bought stationery |

|

|

50 |

|

Jan. 3 |

Paid for registered post |

|

30 |

||

Jan. 4 |

Bought Pen/Pencils for office use |

80 |

|||

Jan. 4 |

Paid for Telegram |

|

|

60 |

|

Jan. 5 |

Paid for refreshment |

|

|

50 |

|

Jan. 6 |

Bought postal stamps |

|

30 |

||

Solution :

Note :

SPECIAL PURPOSE SUBSIDIARY BOOKS

PURCHASES BOOK

In this book, only those transactions are recorded which are related to credit purchases of goods in which the business deals in. Recording is made on the basis of Bills/Invoice issued by the Suppliers.

Transactions not in purchases Book

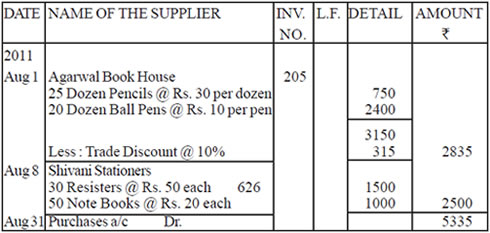

Illustration 5 : Enter the following transactions in the Purchases Book of M/s Ramesh Stationers :

| 2011 | |

| Aug 1 | Bought from Agarwal Book House (Invoice no. 205) 25 Dozen Pencils @ Rs. 30 per dozen 20 Dozen Ball pens @ Rs. 10 per pen Trade discount @ 10% |

| Aug 5 | Bought furniture of Rs. 20,000 on credit from M/s Interior Decor (Invoice no. 109) |

| Aug 8 | Shivani Bros. sold to us (Invoice no. 626) 30 Registers @ 50 each 50 Note Books @ Rs. 20 each |

| Aug 17 | Bought from Tushar stationers for (Cash memo no 101) 300 Refills @ Rs. 5 each 10 Ink pads @ Rs. 50 each |

Solution :

In the books of M/s Ramesh Stationers

PURCHASES BOOK

1. Tansaction of Aug. 5 is related to credit purchases of furniture i.e. an Asset.

2. On Aug. 17, goods bought for cash,

Hence both the transactions are not recorded in Purchases Book.

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]