LEDGER AND TRIAL BALANCE

– Items (Items which, decreases the Pass Book Balance or increase the

Cash Book Balance)

- Cheques sent to the bank for collection but not yet credited by the bank.

- Cheques paid into the bank but dishonoured.

- Direct payments made by the bank.

- Bank charges, commission etc. debited by the bank.

- Cheqes issued but omitted to be recorded in the Cash Book.

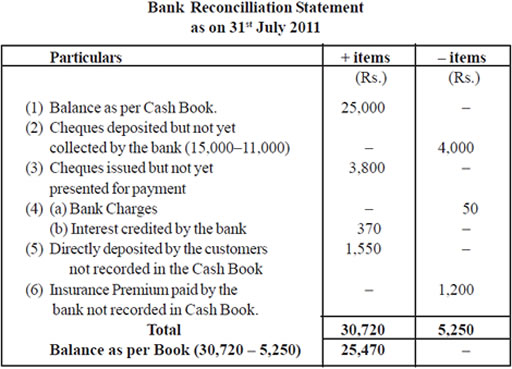

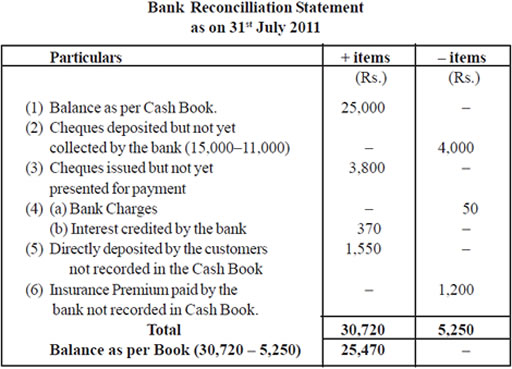

Example 1 : Balance as per Cash Book is given

Prepare BRS as on 31st July 2011

- Balance as per Cash Book is Rs. 25,000 as on 31st July 2011.

- Cheques for Rs. 15,000 were deposited into the Bank in the month of July but

only cheques for Rs. 11,000 were credited by the bank till 31st July 2011.

- Cheues issued for Rs. 13,000 in July, out of which a cheque for Rs. 3,800

was presented for payment on 3rd August.

- Bank charged Rs. 50 as Bank charges and credited interest of Rs. 370.

- A customer directly deposited Rs. 1,550 in tirm's bank A/c.

- Bank paid the Insurance Premium of Rs. 1,200 as per standing instructions on

25.07.2011.

SOLUTION :

Explanation :

- Balance per Cash Book means favourable Balance, hence + item. If nothing

(i.e. Debit or Credit) is written with the Balance given, it is treated as

favourable.

- Cheques were deposited into the bank for Rs. 15,000 but credited by the bank

for Rs. 11,000 in the month of July, implies that cheques for Rs. 4,000 (15,000– 11,000) are entered in the Cash Book but not in the Pass Book increasing the Cash

Book Balance by Rs. 4,000 as compared to Pass Book. Hence to get Pass Book

Balance from the Cash Book Balance Rs. 4,000 will have to be deducted.

- Cheque issued but not presented for payment till 31st July is for Rs. 3800

entered more on the credit side of Cash Book as compared to Pass Book

Cash book Balance is less by Rs. 3800 as compared to Pass Book + item.

- (a) Bank charges of Rs. 50 entered in the Pass Book decreases the Balance

of Pass Book.To reach Pass Book Balance from Cash Book Balance, this item

has to be deducted i.e. – item.

(b) Interest credited by the Bank Rs. 370 entered in Pass Book increases

the, balance of Pass Book, hence to seach the Balance from cash book and this item

is to be added + item

- Direct deposit by a customer Rs. 1,550 increases the Pass Book Balance

+ item

- Payment made by the bank for insurance premium decreases the Pass Book

Balance – item.

- + items total Rs. 30,720 is more than –item total Rs. 5250 by Rs. 25,470.

Hence the difference of Rs. 25,470 will be + item i.e. Favaurable Balance or Cr

Balance as per Pass Book.

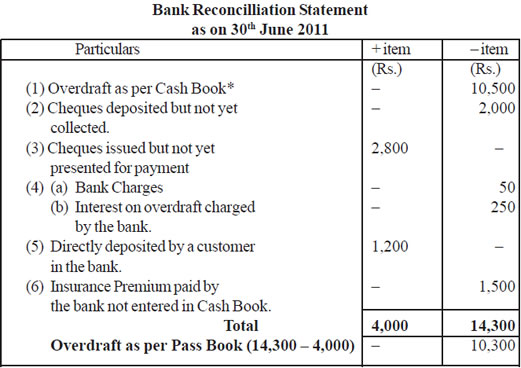

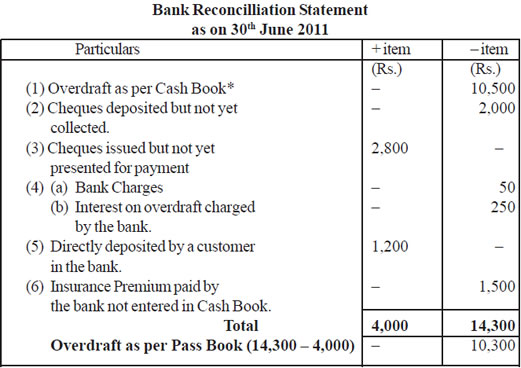

EXAMPLE 2– when overdraft as per Cash Book is given

(1) Overdraft as per Cash Book is Rs. 10,500 on 30th June 2011.

(2) Cheques deposited but not yet collected Rs. 2,000.

(3) Chequs issued but not yet presented for payment of Rs. 2,800.

(4) Bank charges of Rs. 50 and Interest on overdraft of Rs. 250 are. charged

by the bank.

(5) A customer directly deposited Rs. 1,200 into the Bank.

(6) Insurance Premium of Rs. 1,500 is paid by the bank as per standing instructions.

Prepare Bank Reconcilliation Statement for the month of June 2011.

SOLUTION :

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]