LEDGER AND TRIAL BALANCE

EXAMPLE 5 –

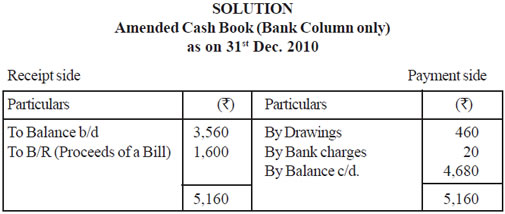

The Cash Book of Mr. Sharma showed a balance of Rs 3,560 as on 31st Dec.

2010 at the Bank where as Pass Book showed a balance of Rs 4,230

Comparison of the Cash Book and Pass Book revealed the following.

- The Bank has debited Mr. Sharma with Rs 460, the annual premum of his life

policy according to his standing instructions and Rs 20 as Bank charges.

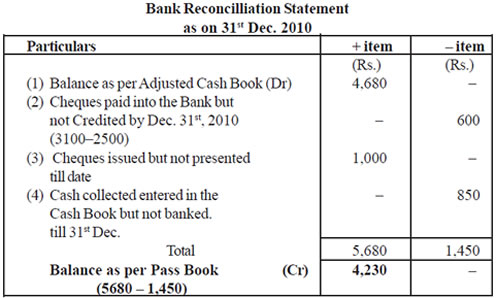

- Mr. Sharma paid into the Bank cheques totalling Rs 3,100 on Dec. 26th 2010

of which those for Rs 2,500 were collected in December. One cheque for Rs 200 was

returnced deshonoured on 2nd Jan. 2011.

- The Bank has credited Mr. Sharma by Rs 1,600, the preceeds of a bill.

- Cash collected on 31st Dec. 2010 totalling Rs 850 was entered in the Cash

Book in the Bank column on the same date but banked on 2.1.2011.

- Mr. Sharma issued cheques totalling Rs 2,300 in the month of Dec. out of

which cheques for Rs 1000 have not been presented for payment till 31st Dec.

Points to Remember

- Amended or adjusted Cash Book is started with the given balance of bank as

per Cash Book.

- Closing Balance of the adjusted Cash Book is the opening balance of Bank

Reconcilliation statement.

- Entry for the dishouner of the cheques of Rs. 200 is not done.

(a) In the Cash Book as its was dishonoured after 31st Dec.

(b) In Bank Reconcilliation Statement it is included in the adjustment (Rs. 3100– 2500)

Methodology Suggested

Teachers are suggested

To show the actual Bank Statement and them by Discussion and Project Mehthod

the topic can be esplained.

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]