IMPORTANT TERMS

1. Term of Bill :

The period intervening between the date on which a bill is drawn and the date on which it becomes due for payment is called 'Term of Bill'.

2. Due Date :

Due date is the date on which the payment of the bill is due.

Due date is ascertained in the following manner :(i) In case of 'Bill at sight' -

Due date is the date on which a bill is presented for the payment.(ii) In case of 'Bill after Date' -

Due Date = Date of Drawing + Term of Bill.(iii) In case of ' Bill after sight' –

Due date = Date of Acceptance + Term of Bill.3. Days of Grace :

Drawee is allowed three extra days after the due date of bill for making payments. Such 3 days are know as 'Days of Grace'. It is a custom to add the days of grace.

4. Date of Maturity :

The date which comes after adding three days of grace to the due date of a bill is called 'Date of maurity'.

llustration 1

A bill of exchange for ` 25000 is drawn by A on B on 1st April, 2011 for 3

Months. B accepted the bill on 10th April, 2011.

Find the DUE DATE and DATE OF MATURITY if

Cash I - The bill is Bill After date

Case II - The bill is Bill After Sight

DUE DATE Date of Maturity Case I - When the Bill is

"Bill After date"1st July 2011 4th July, 2011 Case II When the Bill is

"Bill After Sight"10th July 2011 13th July, 2011 In case a bill is "Bill after Sight" term of bill starts from the date of acceptance.

5. Bill at sight/Bill on Demand

When no time for payment is mentioned in the bill of exchange and the bill is payable whenever it is presented to the drawee for the payment, such bills are know as "Bill at sight" or "Bill on Demand".

3 days of grace are not allowed when bill is payable on demand.

6. Bill after Date

Bill after date is the bill in which due date and date of maturity is ascertained from

the date on which the bill is drawn.

3 days of grace are allowed for ascertaining the date of maturity in case of bill

after date.

7. Discounting of Bill

When the bill is encashed from the bank before its due date, it is known as discounting of bill. Bank deducts its charges from the amount of bill and disburses the balance amount.

Illustration 2

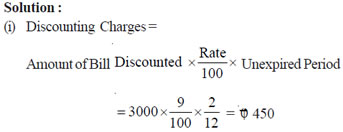

Ram sold goods to shyam for Rs. 30,000 at credit on 1st April, 2011. Ram discountd

theh bill with his bank on 4th May 2011 @ 9% per annum find out :

(i) The amount of discounting charges.

(ii) The amount that Ram will receive from his bank at the time of discounting the bill.

(ii) Ram will receive from his bank ϕ 29,500 (i.e., ϕ 30,000 - 450) at the time of discounting the bill.

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]