Illustration 9.

Following is the Receipt and Payment Account of Tulsi Literary Society for

the ended March 31, 2011. Prepare Income and Expenditure Account for the

year ended March 31, 2011 and the Balance Sheet as on that date.

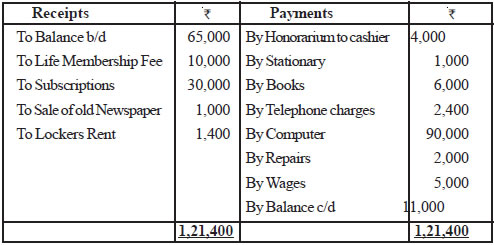

Receipt and Payment Account for year ended March 31, 2011

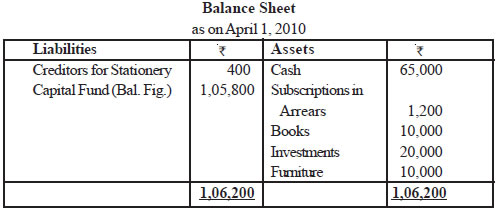

On April 1, 2010 the society had Books of Rs10,000 Investments Rs20,000

and Future Rs10,000. Subscriptions outstanding as on April 1, 2010 were Rs1,200

and as on March 31, 2011 were Rs 1,400.

Creditors for stationery on April 1, 2010 were Rs 400.

Additional books and computers are purchased on April 1, 2010.

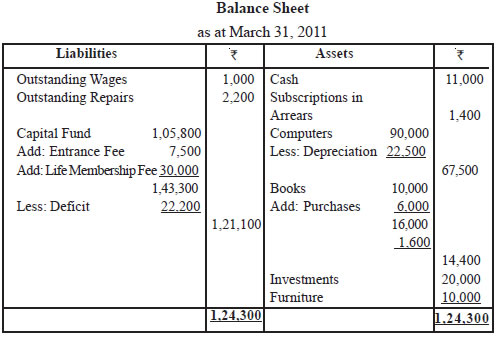

Bills outstanding for repairs as on March 31, 2011were Rs 2,200 and wages

outstanding were Rs 1,000.

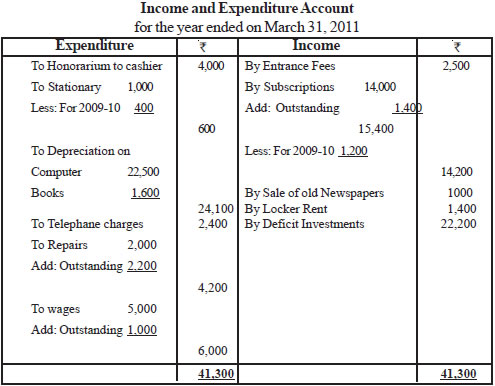

75% of the Entrance Fee is to be capitalized.

Depreciation is to be provided on computers @ 25% p.a. and books @ 10%

p.a.

Solution :

Important Points :

In the obsence of any instruction, Entrance Fee is treated as Income.

Points to Remember :

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]