Procedure of Preparing Bank Reconcilliation Statement

A Bank Reconcilliation Statement is prepared when we get the duly completed Pass Book from the Bank. On receiving the Cash Book

Important Points :

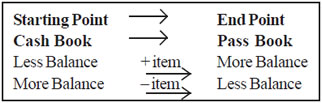

Method of Preparing BRS Starting with by the Balance / overdraft as per Bank Column of Cash Book.

Note :

To get more from less means something is to be added therefore + item & To get less from more, something is to be deducted therefore _ item.

1. First of all write :

Under Plus Item – If the Cash Book Balance is debit or favourable or simple balance.

Under Minus Item – If the Credit Balance or overdraft as per Cash Book is given.

2. Now study the point of difference.

(a) If the entry is done in the Cash Book and not in the Pass Book then .

(i) if it is done on the debit side of Cash Book, Balance in the Cash Book will be more as compared to Pass Book and hence the item will be – item as shown in the box above.

(ii) where as if the entry is done on the Credit side of Cash Book, the Balance in the Cash Book will be less as compared to Pass Book and hence the item will be + item.

(b) If the entry is done in the Pass Book and not in the Cash Book then.

(i) if done on the Credit side of Pass Book– Pass Book Balance is more as compared to Cash Book – item.

(ii) It it is done on the Debit side of Pass Book– Pass Book Balance is less as compared to Cash Book (–) item

3. At the end + items and - items are totalled.

(a) If total of Plus Items is more than the total of (-) items Difference is Cr Balance or favourable balance as per Pass Book.

(b) Where as if the - items total is more than the + items total Difference is Dr Balance or overdraft as per Pass Book. Balance or overdraft as per Pass Book.

Ready Reference

+ Items (Items which increases the Pass Book Balances or decreases the Cash Book Balance)

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]