LEDGER AND TRIAL BALANCE

Important Points –

- Starting and Ending Points are reversed as compared to Example No. 1,

Hence + items and (–) items are interechanged.

- Favourable balance whether of Cash Book or Pass Book is always a + item.

- If + items total is more than the – items total then the difference in the two

totals is always a favourable balance.

- where as if + items total is less than the – items total then the difference in the

two totals is overdraft.

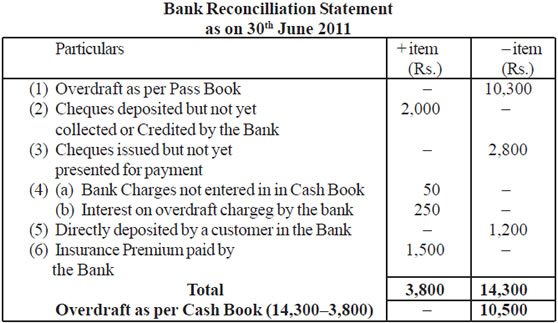

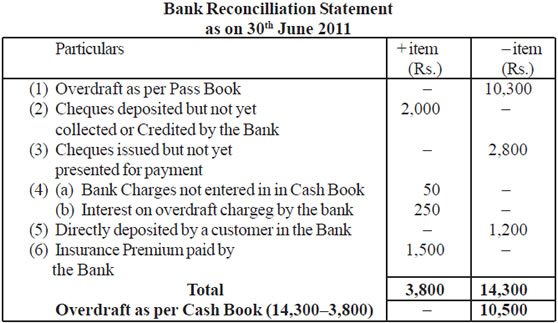

Ecample 4 – Overdraft as per Pass Book is given.

Given that (1) Overdraft as per Pass Book is Rs. 10,300 Rest of the contents

(points 2 to 6) are same as given in example No. 2

Prepare B.R. Statement for the month of June 2011.

SOLUTION :

Important Points –

- Overdraft whether as per Cash Book or Pass Book is always a (–) items.

- Starting and Ending points are interchanged as compared to Example No. 2,

hence + items and (–) are also interchanged.

- Here (–) items total is more as compared to (+) items total, therefore the

difference in the two balance is a negative items i.e. overdraft as per Cash Book.

Amended Cash Book Method

Introduction :

So far we have studied the preparation Bank Reconcilliation Statement

simply by reconciling the causes of differences between the Cash Book and Pass

Book. In actual practice adjustments are done in the Cash Book by comparing the

Bank column of Cash Book with the Bank Statement and after that B.R. Statement is

prepared. It is called Amended Cash Book Method.

Procedure :

(1) Adjusted Cash Book is prpared starting with the Balance of the Cash Book

given in the question.

(2) All errors that have been committed in the Cash Book will have to be rectified

by passing adjusting entries in the Cash Book.

Usual or General Errors are

- Overcasting or Undrcasting of Debit / Credit Column of Cash Book.

- Cheques deposited or Issued but omitted to be entered in the Cash Book.

- Incorrect amount (if any) entered in the Cash Book.

- Entries on the incorrect side or in the wrong column of Cash Book.

- Any amount recorded twice in the Cash Book.

(3) Certain amounts for which Bank has debited our A/c will be recorded on the

Credit side of Cash Book. Such items are

- Interest charged by the bank on overdraft etc.

- Debits made by the bank for the bank charges, commission etc.

- Direct payments made by the Bank on behalf of the A/c holder.

- Cheques sent for collection but dishonoured by the bank.

- Any amount recorded twice in the Cash Book.

(4) Cash Book is then balanced and the new Balance of the Cash Book is taken

as the Starting point for preparing the B.R. Statement.

Important :

- It should be noted that the following items must not be recorded in the

Amended Cash Book.

- Cheques deposited into the Bank but not yet credited by the bank.

- Cheques Issued but yet not presented for payment.

- Any wrong entry in the Pass Book.

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]