The above balance sheet is given in the order of liquidity, if you need in permanancy order reverse the order of asscts and liabilities.

Note 1. If closing stock shown in Trial Balance then it will be shown in balance sheet only. It is assumed that purchases amount already get adjusted in trial balance.

2. Salary and wages will be shown in profit and loss A/c debit side (assuming that salary is prominent) while Wages and salary will be shown in trading A/c debit side. (wages are prominent)

3. Freight, carriage, cartage will be shown in Dr. side of trading A/c. if inward word attached with these then it also debited to trading a/c, if outward word attached with these item then it will be debited to profit and loss account.

4. Any expenses related to factory are debited to trading account like fac- tory lighting, factory rent if factory word is not given then lighting and rent will be debited to profit and loss account.

5. Trade expenses always debited to profit and loss a/c not as name indi- cate trading a/c.

6. Packaging material : cost of packaging material used in product are direct expenses as it refers to small containers which form part sold, it will debited to trading a/c.

7. Packing : the packing refers to the big containers that are used for transporting the goods and regarded as indirect expenses and debited to profit and loss account.

8. Adjusted purchases mean the amount of purchases is adjusted by way of adding opening stock and reduced by the amount of closing stock. e.g., purchases 1,00,000; opening stock 12,000, closing stock

8,000. Calculate adjusted purchases. Adjusted puchases = purchases +

opening stock-closing stock= 1,00,000 +12,000 – 8,000 = 1,04,000

When adjusted purchases is given in trail balance, then there is no need of debiting opening stock and crediting closing stock in trading a/c. In this case closing stock will be shown in balance sheet only.

Calculation of cost of goods sold and preparation of trading account :

Illustration : 1.

Stock as on 01.04.2010 Rs. 10,000;

Sales Rs. 2,00,000; Purchases Rs. 1,45,000; carriage inwards Rs. 4,000; clearing charges Rs. 5,000; sales returns Rs. 1,500; purchases return Rs.2,000; carriage outward Rs. 2,500; stock as on 31.03.2011 Rs. 15,000.

Calculate cost of goods sold and prepare trading account for the year ending 31.03.2011.

Cost of goods sold = net sales – gross profit

= 1,98,500–51,500 = ` 1,47,000

Or opening stock + net purchases + direct expenses-closing stock

= 10,000+1,43,000+4,000+5,000–15,000 = 1,47,000

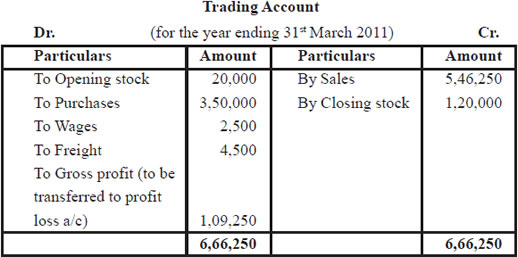

Illustration :2. Calculate cost of goods sold and prepare trading account for the year ending 31.03.2011 from the following information.

Opening stock Rs. 2,00,000; purchases Rs. 3,50,000; closing stock Rs. 1,20,000; Wages Rs. 2,500; freight Rs. 4,500; carriage outward Rs. 5,500; trade expenses Rs. 2,500.

The percentage of gross profit on sales is 20%

Sol: Calculation of cost of goods sold = opening stock + puchases + direct exp. Closing stock

= 2,00,000 + 3,50,000 + 2,500 + 4,500 – 1,20,000

= ` 4,37,000

Let sales = ` 100; then gross profit = ` 20,

Therefore cost of goods sold will be = ` . 100–20 = ` 80

If cost of goods sold is ` 80, then sales is = ` 100

If cost of goods sold is ` . 4,37,000, then sales = 100/80×4,37,000 =

5,46,250

CBSE Accountancy Class XI ( By Mr. Aniruddh Maheshwari )

Email Id : [email protected]